Whether you’re operating as a sole trader or part of a partnership, we know there’s no one-size-fits-all solution. That’s why we take a tailored approach — offering accounting services built around the unique needs of your business.

We’ll work closely with you to understand how your structure affects everything from tax to cash flow, helping you make informed decisions and supporting your long-term goals with practical, personal advice.

We know that pulling everything together for your year-end accounts as a sole trader or partnership can feel overwhelming — and with accuracy being so important, there’s little room for error.

Our Year End Accounts Preparation service is designed to ease that pressure. We’ll take care of the process for you, ensuring your figures are accurate, compliant, and submitted on time — giving you peace of mind and more time to focus on running your business.

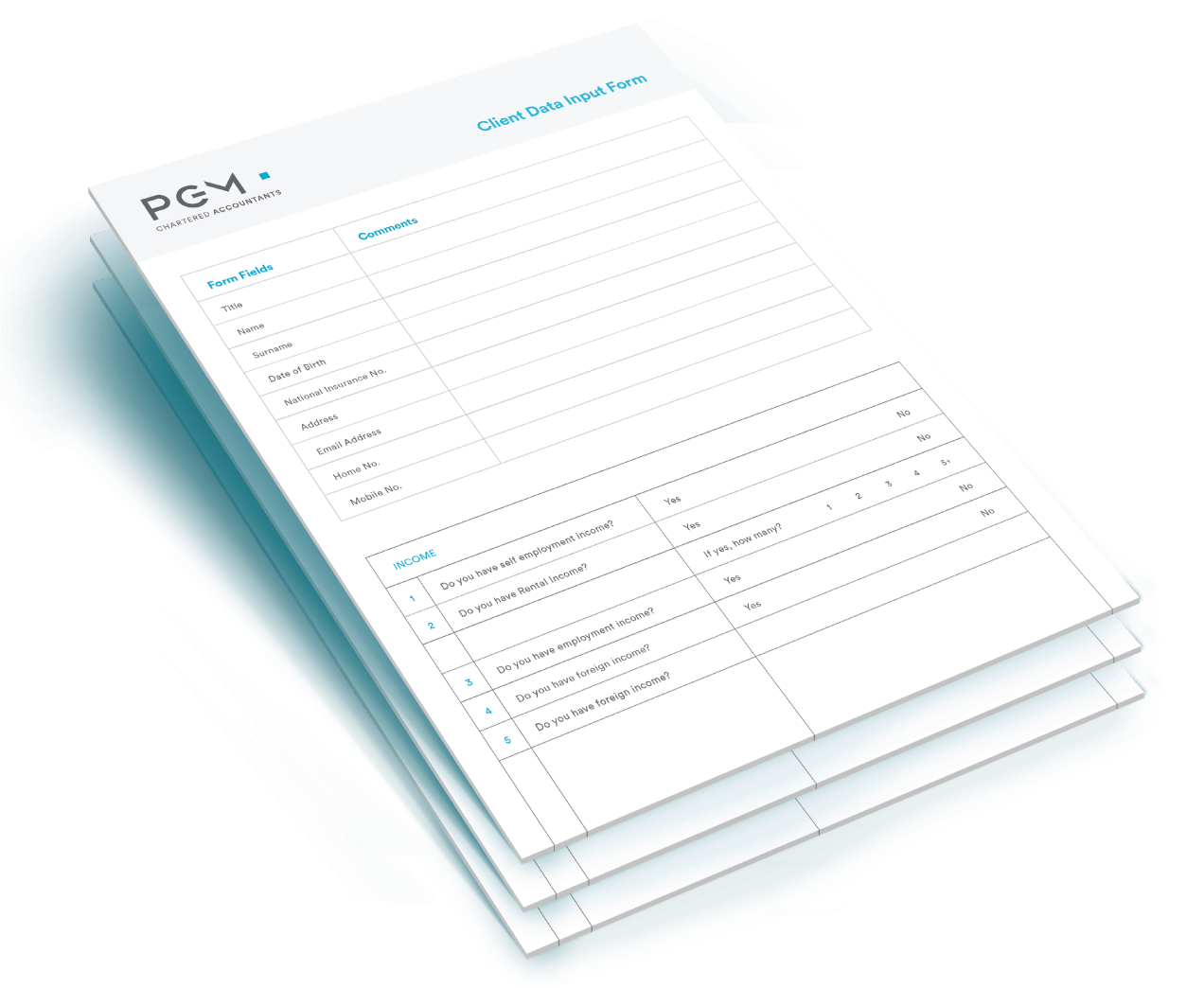

As a sole trader or member of a partnership, keeping up with HMRC’s ever-evolving rules around self-assessment can be time-consuming and stressful — but it doesn’t have to be.

At PGM, we take the pressure off by managing the process for you. Our team has deep experience across both personal and business tax, so we can ensure your return is completed accurately, on time, and in line with the latest legislation. You’re welcome to pop into our Belfast or Lurgan office to chat with one of our tax managers — or, if you prefer, use our online tax return service for extra convenience.

Submitting your tax return couldn’t be simpler with PGM. Our no‑nonsense approach to online tax returns is designed to make your life easier and take the stress out of filing a tax return.

Fill out our registration form and receive a quote within two working days.

We will set up your secure client portal.

Fast and effective submission.

If you're looking to reduce your tax liabilities, keep your strategies on track, and stay compliant with HMRC, expert support can make all the difference.

Whether you need guidance on Capital Gains Tax, a review of your overall tax position, or tailored planning to help you meet your financial goals, our team is here to help. We’ll work closely with you to provide clear, practical advice that supports your business decisions — both now and in the future.

If you’re a sole trader or in a partnership and have taken on employees, auto enrolment is something you can’t afford to overlook. As an employer, you're legally required to set up a qualifying workplace pension scheme, assess your staff for eligibility, and make regular contributions to their pensions.

At PGM, we understand that managing pensions can feel like just another task on an already full plate. That’s why we offer a full auto enrolment service — handling everything from setup to ongoing compliance. We’ll help you meet your obligations with ease, so you can stay focused on running and growing your business.

No matter the size or stage of your business — whether you're just starting out or planning your next phase of growth — we offer planning and projection services designed to help you move forward with confidence. As a sole trader or partnership, having clear, practical guidance can make all the difference.

We take time to get to know your business inside and out, so we can offer advice that’s both realistic and tailored to your goals. From building bespoke business plans to forecasting your financial future, we’re here to support your progress every step of the way.

As a sole trader or partnership, you might be overlooking valuable savings through capital allowance claims. Whether you’re investing in machinery, vehicles, computers, or other significant assets, there’s a strong chance you can claim back some of these costs. Our team will review your asset purchases and advise on the best way to maximise your cash flow and take full advantage of available allowances.

When it comes to selling an asset, it’s crucial to minimise any tax liabilities that might arise. If you’re unsure whether to go ahead with the sale, we can guide you through the options and help you make the best decision—making sure you avoid any unexpected tax bills along the way.

If you work with subcontractors, you’ll be familiar with the monthly CIS return requirements for HMRC. By handling the preparation and submission of these returns on your behalf, we can relieve you of this administrative task, freeing up your time to focus on running your business.

As a subcontractor, it’s essential that your tax is accurately assessed and deducted, so you only pay what you truly owe. We’ll handle the entire tax return submission process for you, making sure any tax already deducted is properly accounted for—giving you peace of mind and more time to focus on your work.

At PGM, we can assist you in reclaiming the EU VAT you’re entitled to. If your business has paid VAT on goods or services purchased in another European Union country, and you’re registered for VAT in the UK, you can use the VAT refund scheme to recover that cost. We handle the entire process for you, saving you valuable time and making sure you get the refunds you deserve.

Rewarding your team brings valuable benefits for both your business and your employees. By making sure this is done in the most tax-efficient way, we can help you put in place strategies that allow you to recognise and reward your staff without facing unnecessary costs.

Thinking about incorporating your business? Doing so could offer you important liability protection and potential tax advantages. We’ll help you weigh up the benefits and drawbacks of forming a limited company and work with you to decide if remaining a sole trader or partnership might be a better fit for your circumstances.

If you’re concerned about the tax burden your family might face after you pass away, we’re here to help. We’ll review your financial situation and explore options to minimise the impact of inheritance tax on your estate and those who benefit from it.

Couples with differing annual incomes could see significant benefits from a simple tax review. Our couple’s ‘health check’ assesses your current tax position and suggests ways to reduce the amount of tax you pay.

HMRC PAYE inspections can be stressful, but our PAYE & NIC health check is here to put your mind at ease. We’ll carefully review your current setup—covering Payroll, Benefits & Expenses, Forms P11D, and NIC—to ensure everything is fully compliant and in order.

Without a thorough review of your strategy, you could face unexpected tax liabilities. With dividend income and interest rules constantly evolving, having PGM on your side means you’ll always be receiving money from your company in the most tax-efficient way possible. If you’re not, we’ll provide clear advice on how to improve your approach.

Whether you’ve recently arrived in the UK or are planning to leave, there are several tax rules that could affect you depending on your situation. If you’re a UK resident but domiciled abroad, you might not be aware of recent changes in the regulations. We’ll review your personal circumstances and help you understand the potential impact on you and your family, ensuring you’re fully informed and prepared.

If you’re considering buying, selling, or renting a second property, it’s important to understand the tax implications involved. With several changes in recent years, we’ll help you stay informed about your financial responsibilities, so you can avoid any unexpected surprises down the line.

If you’re stepping down from the family business, handing over the reins to the next generation can bring significant tax implications. We’re here to guide you through the process, helping make the transition as smooth and tax-efficient as possible.

Our VAT health check offers peace of mind by making sure your company complies fully with HMRC VAT rules. We’ll carry out a thorough review and help identify the VAT scheme best suited to your business, ensuring you’re registered on the right, most tax-efficient plan.

Want to find out more about how PGM’s services can help you?

Come and see us for a free 45-minute consultation with one of our qualified chartered accountants. We’ll get to know you, or your business, and explore how our services will be beneficial in providing the financial solutions that you need.