Professional Support for Your Credit Union’s Success

With complex accounting needs and strict regulatory requirements, your credit union’s success depends on expert guidance.

Our experienced auditing team has worked closely with credit unions to deliver thorough internal and external audit services. We’re here to ensure compliance, add real value, and offer practical advice to help you improve.

Flexible Support to Meet Your Reporting Deadlines

We know reporting deadlines can be tight for most credit unions. That’s why we offer flexible timing for our Year End Accounts Preparation service to fit your schedule.

Our team will guide you every step of the way, making sure all regulations are fully met while maintaining the independence of your audit.

Making Tax Returns Simple and Stress-Free for Credit Unions

With HMRC’s rules constantly evolving, completing tax returns can be a challenge — but with PGM, it doesn’t have to be. Our team has extensive experience handling both personal and business tax for credit unions across the UK. We’ll navigate the complexities on your behalf, helping to ease the pressure and keep your finances on track.

If you’d like to find out more, you’re welcome to visit us at our Belfast or Lurgan offices to speak with one of our tax managers. Alternatively, you can take advantage of our convenient online tax return service.

Get in touch — we’re here to support your credit union’s success.

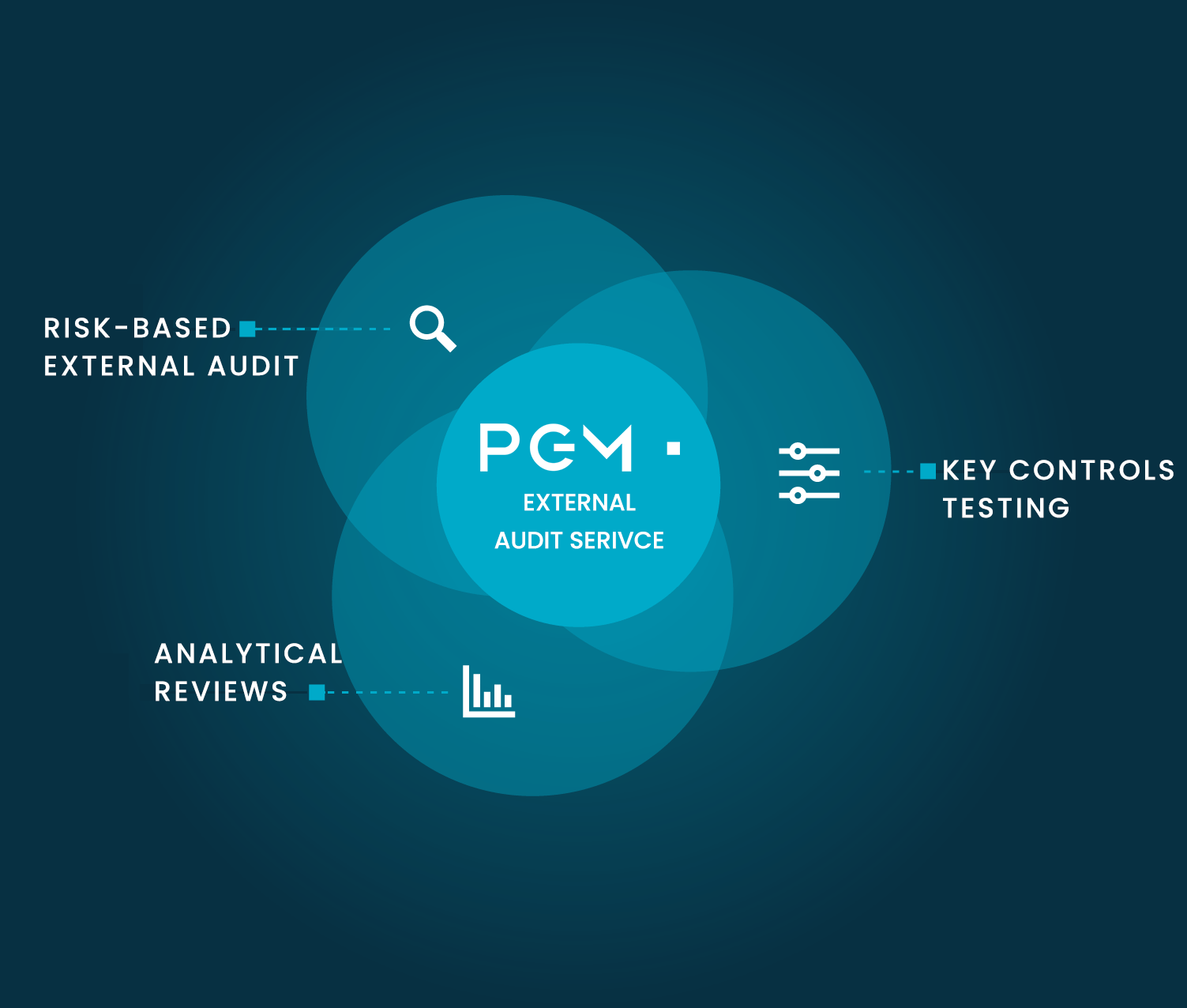

Expert Support for Your Credit Union’s External Audits

At PGM Chartered Accountants, we partner with your team to deliver thorough external audits that meet all regulatory standards. With our technical expertise and understanding of credit union requirements, we help ensure your audit process is smooth, compliant, and adds real value to your organisation.

Easy access to sources of finance – such as bank loans

Additional assurance to members of the Credit Union and the FCA and the PRA

Provide assurance that your financial statements are accurately stated

Benefit from more informed decision making

Receive detailed management letters outlining internal weaknesses and recommendations for improvement

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

To help ensure your external audit is completed on time, we carry out an interim review. This includes an initial risk assessment and completing key control tests to keep everything on track.

If needed, we can help prepare your draft financial statements and support you with any accounting matters—whether it’s posting accruals and prepayments, calculating depreciation, or making sure your accounts follow the right format.

We visit your site to carry out the year-end audit, making sure all regulatory requirements are met and that your accounts accurately reflect your financial position.

We present our audit findings at the AGM through our audit opinion and provide the Board with a management letter outlining key points and recommendations.

We provide hands-on support in preparing your annual return, guiding you through each step to ensure all the necessary information is accurate and complete. Our aim is to make the process as straightforward as possible, so your return is submitted on time, by the 31st of March each year, keeping your credit union fully compliant with regulatory requirements.

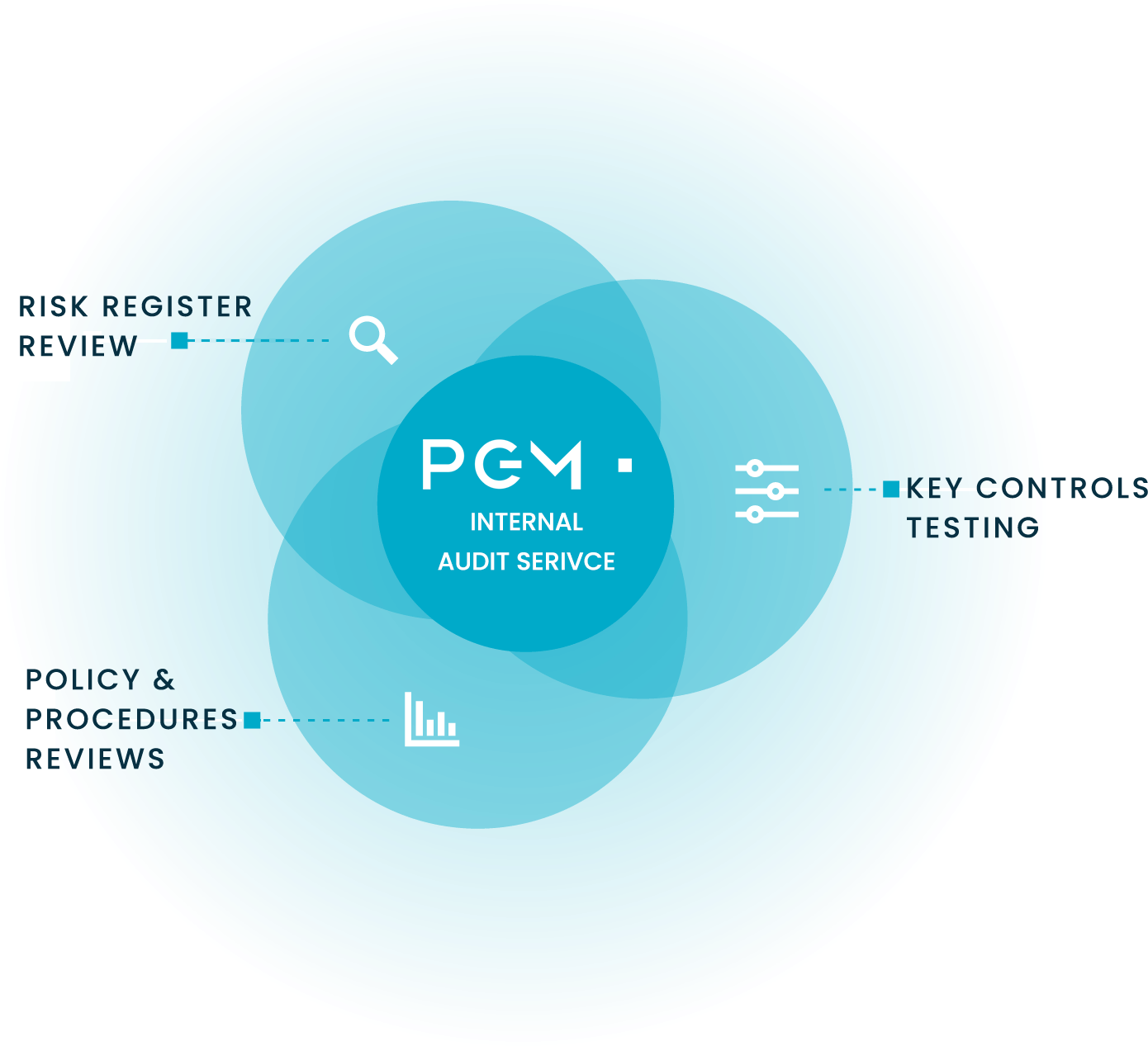

Supporting Your Credit Union’s Internal Audit Needs

At PGM Chartered Accountants, we work closely with your existing supervisors to provide the technical expertise and training needed to meet the regulatory requirements of your internal audit function.

Our goal is to help your credit union maintain strong, compliant oversight with confidence.

We work alongside your supervisory committee to build a strong, efficient control environment tailored to your credit union’s needs. Our approach helps improve performance, boost transparency, and provide clear assurances to your members. By spotting issues early, we also offer practical recommendations to help you keep moving forward.

A bespoke internal audit plan.

Bi-annual visits from PGM staff.

Bi-annual reports.

Telephone and email support.

Year-end report.

Ongoing training provided to the supervisory committee.

A bespoke internal audit plan.

Quarterly visits from PGM staff.

Quarterly reports.

Telephone and email support.

Year-end report.

Ongoing training provided to the supervisory committee.

A bespoke internal audit plan.

Quarterly visits from PGM staff.

Quarterly reports.

Telephone and email support.

Year-end report.

Ongoing training provided to the supervisory committee.

A bespoke internal audit plan.

Quarterly visits from PGM staff.

Quarterly reports.

Telephone and email support.

Year-end report.

Ongoing training provided to the supervisory committee.

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

Our audit and assurance services are designed to spot internal system risks and weaknesses, suggest improvements, and help strengthen your credit union’s reputation by ensuring you meet all essential compliance requirements.

Compliance deadlines can be stressful, pulling your focus away from what really matters—helping your credit union grow and serve its members. Take the pressure off with our comprehensive company secretarial service. We’ll handle all the deadlines and paperwork, so you can concentrate on building your credit union’s future without worry.

When you use our internal and external audit services, we provide detailed reports to your credit union board on a monthly, quarterly, and annual basis. Beyond audits, we offer consultancy services to help enhance your monthly management information, assist with Prudential Regulatory Authority (PRA) stress testing, and support you in setting competitive loan interest rates that benefit your members.

Our team provides thorough advice and support when preparing reports for the Financial Conduct Authority (FCA). We understand the specific FCA requirements and stay up to date with any changes, ensuring your reports are fully compliant and submitted with confidence.

Annual reporting to the Financial Conduct Authority (FCA) involves many detailed requirements, so accuracy is essential. To help you get it right, we offer professional support with preparing and submitting both your annual and quarterly reports, ensuring everything meets FCA standards.

Want to find out more about how PGM’s services can help you?

Come and see us for a free 45-minute consultation with one of our qualified chartered accountants. We’ll get to know you, or your business, and explore how our services will be beneficial in providing the financial solutions that you need.