We offer tailored services designed to simplify your finances, save you time, and keep you in control.

As a director, managing both your personal and company tax can be complex. Our expert team makes sure you stay compliant and tax-efficient—whether it’s handling your salary, dividends, or planning for the long term.

From preparing tax returns to developing smart remuneration strategies, we’re here to support directors every step of the way.

Keeping up with constantly changing HMRC rules can take up valuable time — but with PGM, it doesn’t have to be.

Our experienced tax team specialises in corporate tax returns for directors. We manage the complexities, stay on top of the latest regulations, and ensure your business remains fully compliant — so you can focus on growing your company, not paperwork.

Drop by our Belfast or Lurgan office to speak with one of our tax managers, or get started easily with our convenient online tax return service today.

Submitting your tax return couldn’t be simpler with PGM. Our no‑nonsense approach to online tax returns is designed to make your life easier and take the stress out of filing a tax return.

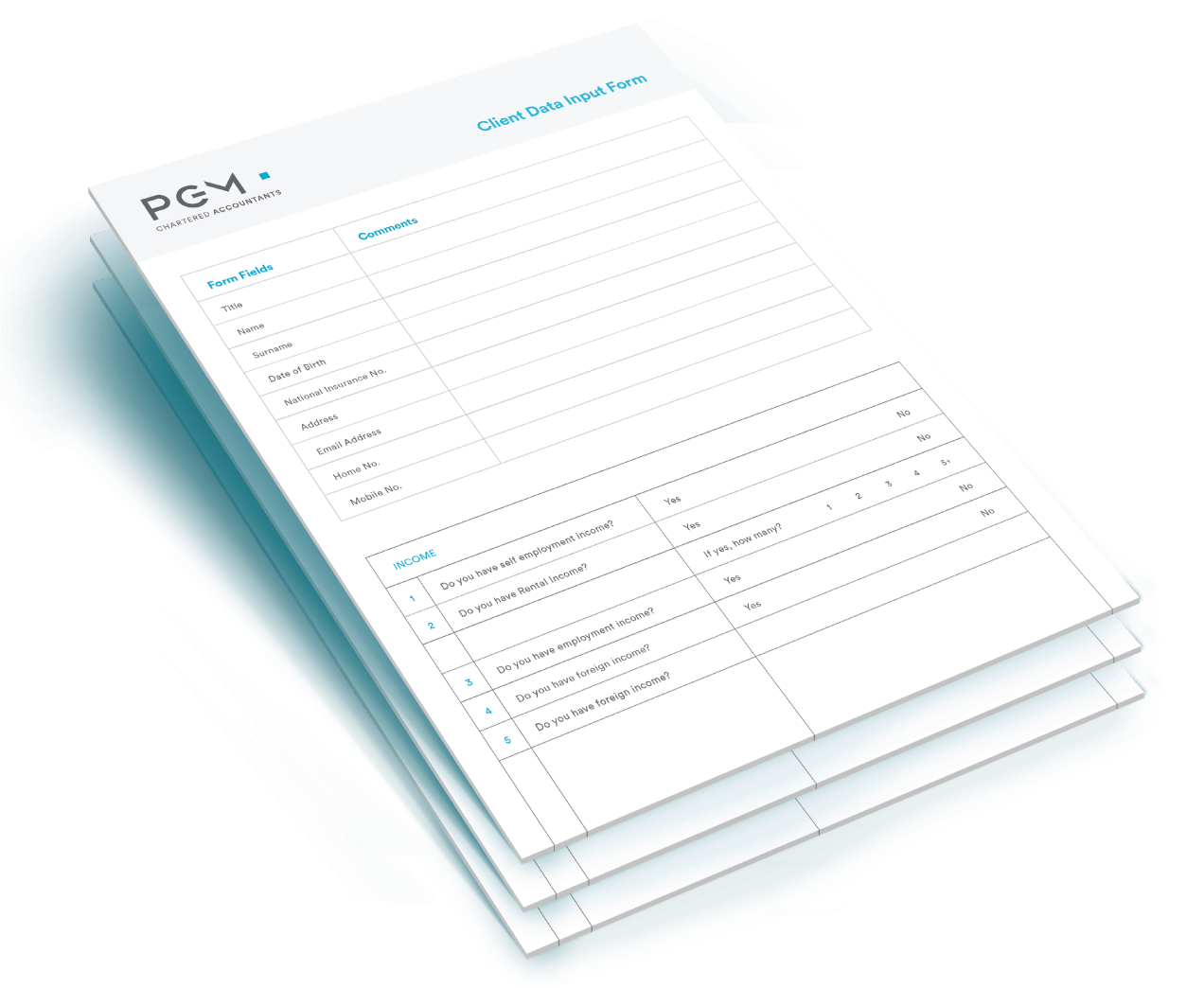

Fill out our registration form and receive a quote within two working days.

We will set up your secure client portal.

Fast and effective submission.

Our proactive tax service is designed to help you make the most of every opportunity available. We provide bespoke tax-saving advice tailored specifically to your business situation. From business planning and forecasting to EU VAT returns and auto enrolment, we’ll work with you to find smart ways to grow your business and achieve your financial goals. If you want to minimise your tax burden, review your strategies, and stay fully compliant, our expert guidance is here to support you every step of the way.

Auto enrolment has already had a significant impact on employers across the UK. Most employers are required to set up a qualifying workplace pension scheme and automatically enrol eligible employees. You’ll also need to make regular contributions to your workers’ pensions each pay period.

Now more than ever, it’s crucial to understand your legal responsibilities as an employer to avoid penalties. We can manage the entire auto enrolment process for you, taking the hassle off your plate and ensuring you stay fully compliant.

Before we get started, we take the time to fully understand your business and its future goals. This allows us to assess your situation and help you choose the most tax-efficient structure for your company.

Getting this right is crucial—it can shape the way your business grows and operates. Our team will guide you through selecting the right structure, helping you avoid potential tax pitfalls down the line and setting you up for success.

No matter the size of your business, we’re here to support all your planning and projection needs. Whether you’re a start-up bringing a new idea to market or an established business aiming to grow, we offer practical, tailored advice aligned with your long-term goals.

We take the time to fully understand your business before we begin, guiding you in crafting bespoke business plans that help you build and develop with confidence.

Your business might be missing out on valuable savings through capital allowance claims. Whether you’re investing in machinery, vehicles, computers, or other major assets, there’s a strong chance you could be eligible to claim.

Our team can review your asset expenditures and advise on the best strategies to maximise your cash flow and keep more money working for your business.

When it comes to selling an asset, it’s important to minimise any tax liabilities. If you’re unsure about whether to go ahead with a sale, we’re here to advise you on the best course of action—helping you avoid any unexpected tax bills along the way.

If you work with subcontractors, you’ll know the monthly responsibility of submitting CIS returns to HMRC can be time-consuming. We can handle the processing and submission of these returns for you, freeing up your schedule so you can focus on other important parts of your business.

As a subcontractor, it’s essential your tax is properly assessed and deducted so you only pay what you owe. We can manage the entire tax return submission process for you, making sure all previously deducted tax is correctly accounted for.

Rewarding your staff brings benefits for both your business and your team. We’ll help you implement the most tax-efficient methods, so you can recognise their hard work without unnecessary costs.

At PGM, we can help you reclaim the EU VAT you’re entitled to. If your business pays VAT on goods or services bought in other EU countries, and you’re registered for VAT in the UK, you can use the VAT refund scheme to get that money back. We’ll handle the entire process for you, saving you time and making sure you receive the refunds you deserve.

If you’re concerned about the tax burden your family might face in the future, we’re here to help. We’ll review your financial situation together and explore strategies to reduce the impact of inheritance tax on your estate and those you care about.

HMRC PAYE inspections can feel stressful, but our PAYE & NIC health check is designed to put your mind at ease. We’ll review your current setup—covering Payroll, Benefits & Expenses, Forms P11D, and NIC—to make sure everything is in good order.

Without a thorough review, unexpected tax charges could catch you off guard. With dividend and interest rules always evolving, having our team by your side means you’ll stay on top of tax-efficient ways to receive money from your company. And if there’s room for improvement, we’ll show you how to make it work better for you.

Stepping down from the family business and passing the reins to the next generation can bring significant tax challenges. We’re here to guide you through the process, helping make the transition as smooth and tax-efficient as possible.

We can carry out a thorough VAT health check to make sure your business complies fully with HMRC VAT regulations, giving you complete peace of mind. Our detailed assessment will also help identify the VAT scheme best suited to your business, so you’re registered correctly and in the most tax-efficient way possible.

Want to find out more about how PGM’s services can help you?

Come and see us for a free 45-minute consultation with one of our qualified chartered accountants. We’ll get to know you, or your business, and explore how our services will be beneficial in providing the financial solutions that you need.