Whether you’re running a long-standing family firm or launching a new venture together, we offer services designed to simplify your finances, save you time, and support your goals.

Family businesses face unique challenges — from ownership structures to succession planning. Our experienced team ensures you're prepared, compliant, and tax-efficient every step of the way.

We also advise on director remuneration, profit extraction, and planning for the next generation.

For family businesses, preparing Year End Accounts can feel overwhelming — especially when you're juggling day-to-day operations and long-term planning.

At PGM, we work closely with your family team to ease the pressure. We deliver accurate, compliant accounts that reflect your business's true position, ensuring everything is reconciled and in order. We'll also highlight any tax-saving opportunities early, helping you make informed decisions for the future.

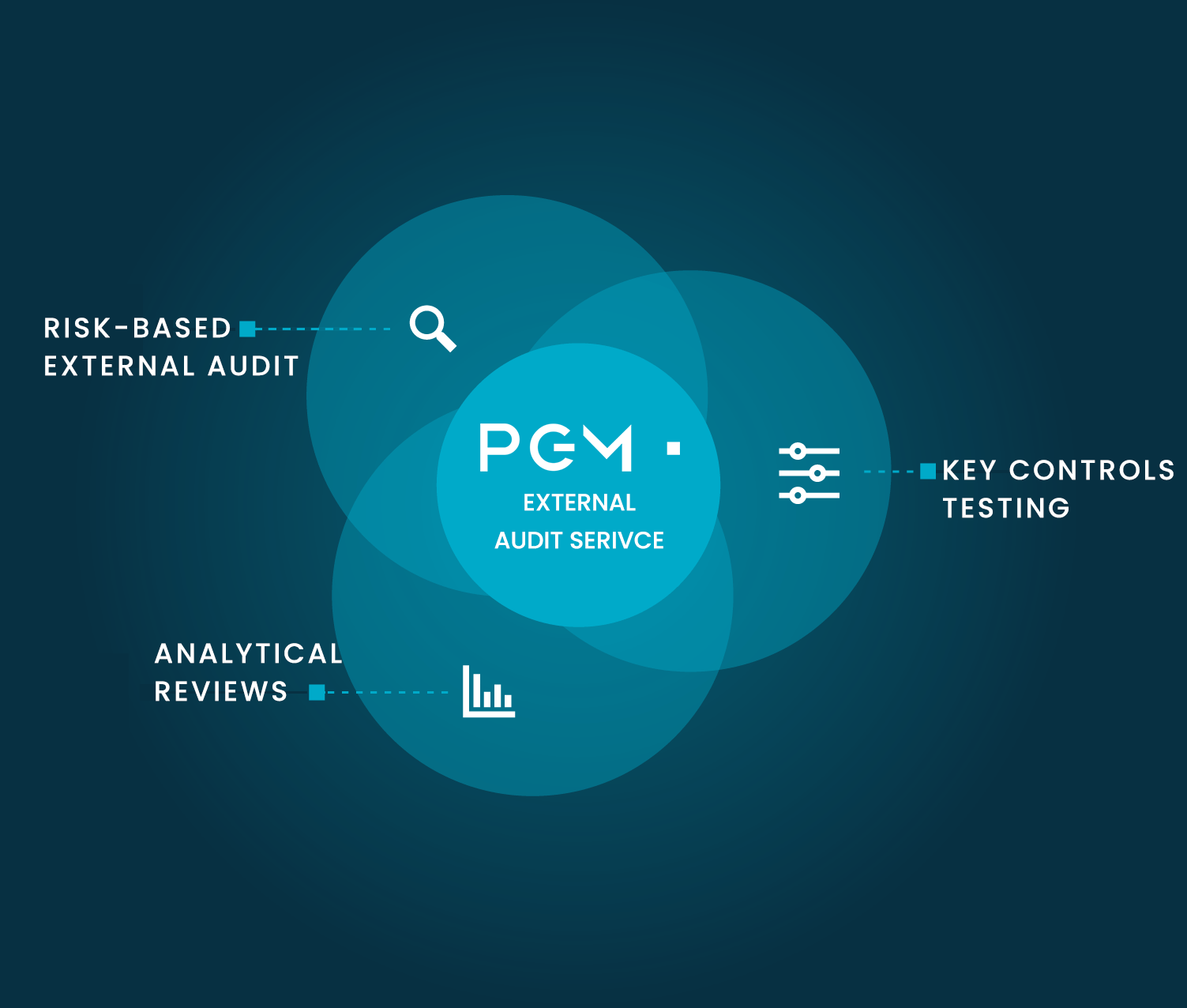

With over 50 years' combined experience, our team understands the unique dynamics of family-run businesses. We provide thorough external audits that not only ensure compliance but also support long-term stability and growth.

From retail and construction to manufacturing, financial services, technology, and care — we bring industry insight and a personal approach that suits the values of family-led enterprises.

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

The strength of a family business lies at its core — in the people, the processes, and the shared vision. Our internal audit service helps you protect that foundation and unlock your full potential.

We’ll review your operations with care and attention, identifying areas for improvement and offering clear, practical recommendations to support your long-term success.

Our extensive reporting identifies areas for improvement by flagging anything we deem to be a potential risk to your company.

Our team follow a simple traffic light system, allowing you to prioritise areas of concern and digest information easily. Any areas issued with an amber or red rating will always include recommendations on how to reduce the risk severity.

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

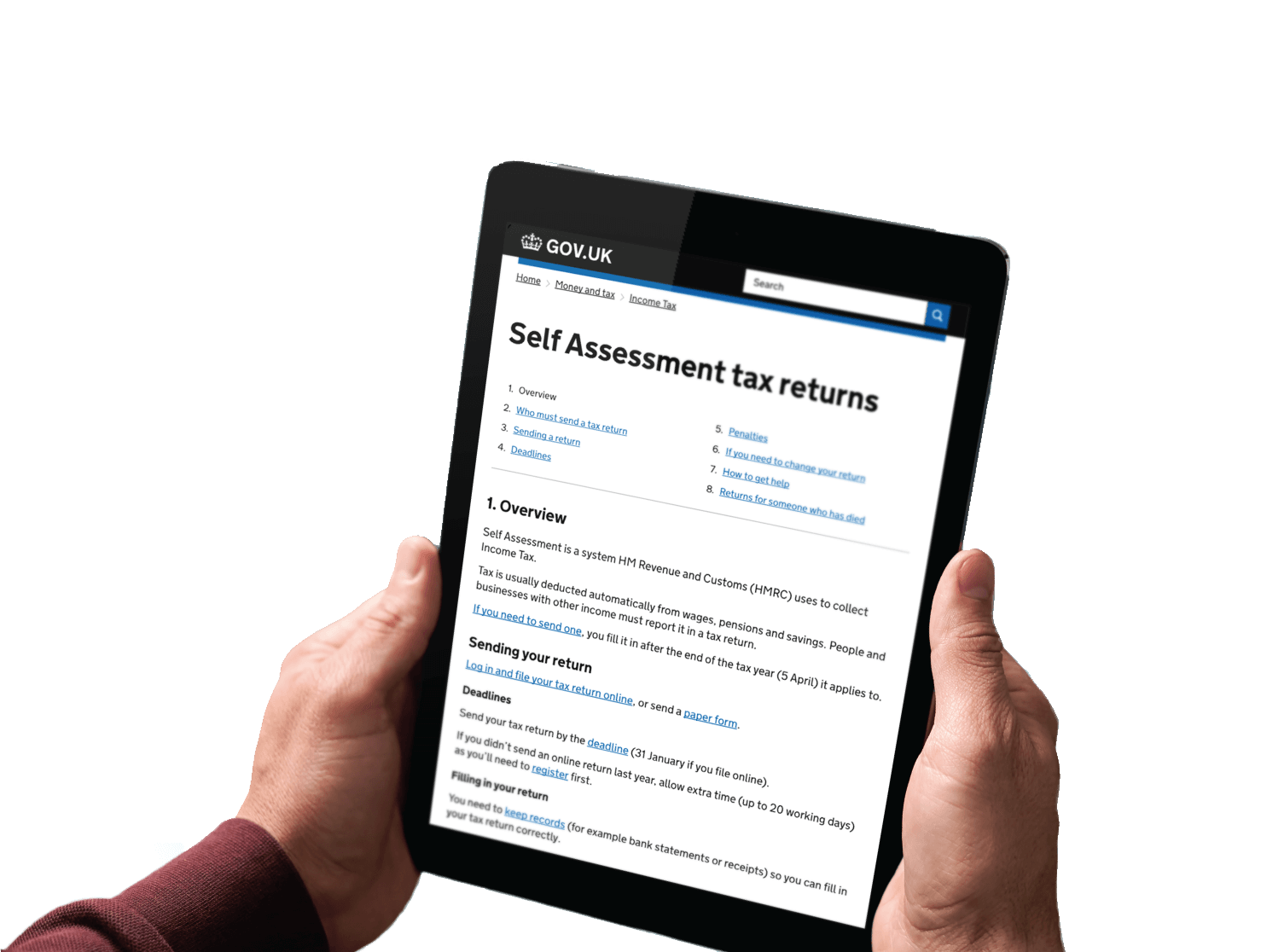

Tax returns can be a real burden — especially when you're balancing the needs of both the business and the family behind it. With HMRC rules constantly changing, it’s easy to feel overwhelmed — but with PGM, it doesn’t have to be.

Our experienced team understands the unique challenges family businesses face. We handle both personal and business tax with care, helping you stay compliant, minimise liabilities, and free up time to focus on what matters most.

Drop into our Belfast or Lurgan office to speak with one of our tax managers, or use our convenient online tax return service.

Get in touch — we're here to help.

Corporate tax affects more than your bottom line — it impacts family income, reinvestment, and long-term stability. Family-run companies often blend personal and business finances, making smart tax planning essential.

At PGM Accountants, we help you make the most of your structure, reduce risk, and plan ahead — all while staying fully compliant with HMRC and Northern Ireland-specific regulations.

We don't just look at the numbers. We understand the dynamics of family-led businesses, including:

We’ll guide you through corporate tax with a strategy that protects both your business and your family’s future.

Our proactive tax service ensures that all our clients maximise the opportunities available to them. We offer bespoke tax saving advice tailored to your business circumstances. From business planning and projection to EU VAT returns and auto enrolment, we can implement ways of progressing your business and help you to meet your financial goals. If you want to reduce the impact of taxes, review your strategies and ensure you remain compliant you will require our expert guidance.

Maximise profits while staying compliant with UK corporate tax laws and Northern Ireland regional considerations. We help structure your business for: Tax efficiency, Strategic reinvestment, Future-proofing ownership

We help directors and family members take income in a way that’s tax-efficient and aligned with your personal financial goals. We look at: Salary vs. dividends, Pension contributions, Use of family trusts or holding companies

Family succession can trigger unexpected tax liabilities. We provide strategies for:

Tax-efficient share transfers,

Business property relief (BPR) for inheritance tax,

Protecting control while bringing in the next generation

From selling company assets to exiting the business, we ensure CGT is minimised where possible — including the use of Entrepreneurs’ Relief (now Business Asset Disposal Relief) where eligible.

For family businesses, succession isn't just a financial decision — it's a deeply personal one. Whether you're preparing to retire, step back, or pass the business on to the next generation, having a clear and well-structured succession plan is vital to:

At PGM, we help family businesses across Northern Ireland transition with confidence — balancing family dynamics, business needs, and financial efficiency.

We begin with a confidential consultation to understand your goals, family structure, and any concerns. Then we collaborate with your solicitor and financial adviser (if needed) to create a plan that reflects your business and your values.

We keep things practical, people-first, and future-focused.

Want to find out more about how PGM’s services can help you?

Come and see us for a free 45-minute consultation with one of our qualified chartered accountants. We’ll get to know you, or your business, and explore how our services will be beneficial in providing the financial solutions that you need.