Running a club or charity is rewarding — but it also comes with its challenges. That’s why getting your financial accounting right is so important.

Our Year End Accounts Preparation service helps take the pressure off, making sure everything’s accurate and professional. Plus, having well-prepared accounts can open doors, like making it easier to secure finance. It’s a smart step with nothing to lose.

We Understand Your Deadlines

Reporting deadlines can be tight for many credit unions — that’s why our Year End Accounts Preparation service is completely flexible to fit your schedule.

Our team will guide you through every step, making sure all regulations are met and your audit remains fully independent and trustworthy.

Audits That Support Your Club or Charity

While many audits are required, our external audit service is designed to do more than just tick boxes. We provide a thorough review that helps your club or charity stay transparent, compliant, and confident in your financial management.

With over 50 years of combined experience working with clubs and charities, we understand the unique challenges you face. Our careful attention to detail means you get quality assurance you can trust — so you can focus on what really matters: your community and cause.

The type of external audit your charity needs depends on its annual income. Different income levels come with different requirements — and we’ll help you understand exactly what steps to take, so you’re always following the right path.

Easy access to sources of finance – such as bank loans

Additional assurance to potential donors or funders

Provide assurance that your financial statements are accurately stated

Benefit from more informed decision making

Receive detailed management letters outlining internal weaknesses and recommendations for improvement

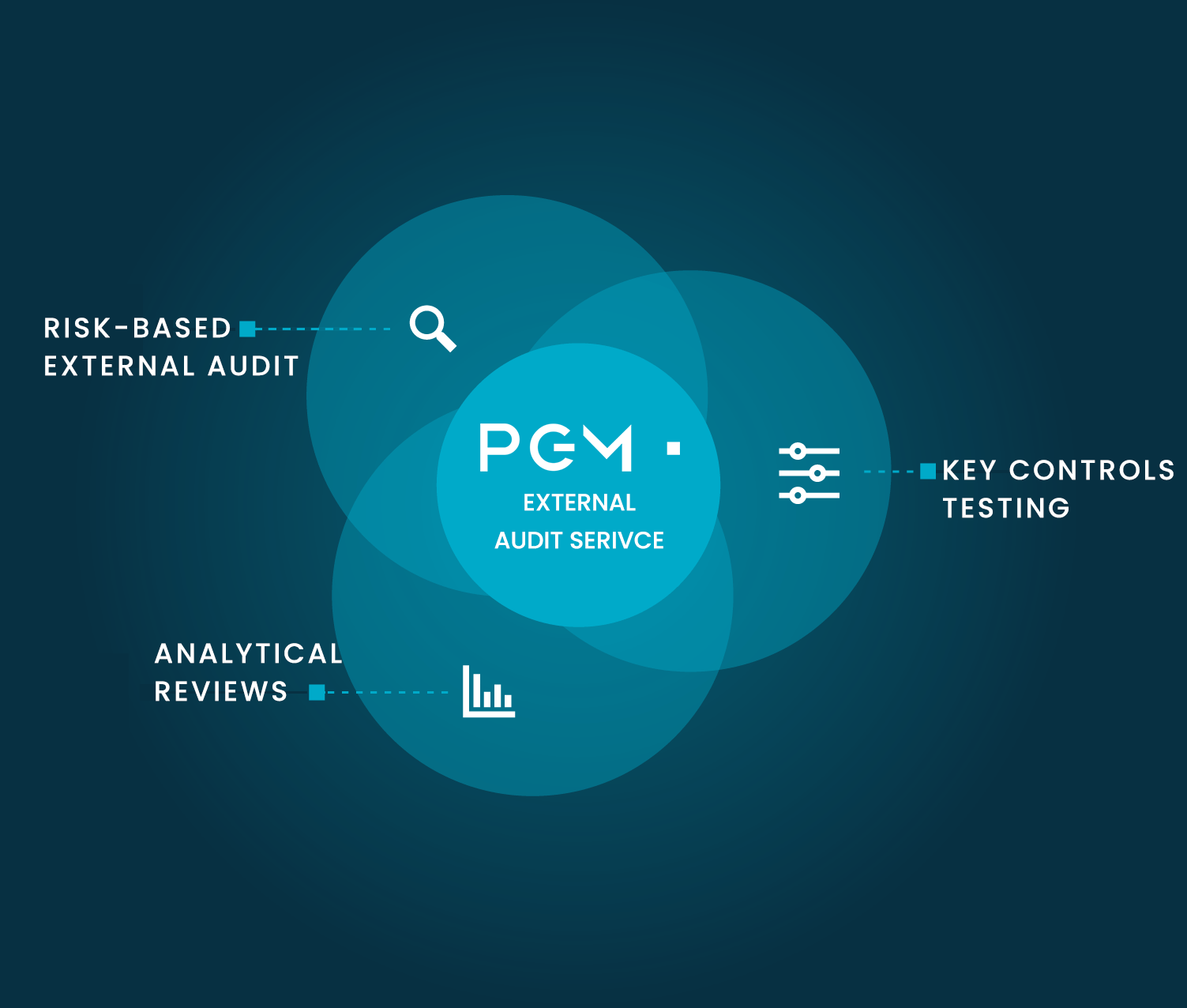

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

We’ll provide a clear quote upfront for our external audit services — so you know exactly what to expect, with no hidden fees. Once you’re happy to proceed, we’ll send over an engagement letter for your approval before getting started.

We’ll work closely with your management team to fully understand your business. By identifying the key audit risks, we create a tailored audit plan focused on reducing those risks. Then, we’ll meet with your team to agree on the audit’s scope and timeline, ensuring a smooth and clear process from start to finish.

Most of the audit fieldwork happens on-site, where we’ll meet your team and review important procedures and controls. We keep communication open throughout, regularly updating management on progress and any potential issues. Once the work is complete, two members of our internal management team will carefully review everything to ensure quality and accuracy.

After the audit, we’ll provide an audit report and management letter that highlight any internal control weaknesses we’ve found, along with practical recommendations to help you improve.

Helping Your Club or Charity Grow Stronger

Our expert auditors will review your club or charity’s internal practices, spot areas that could be improved, and help you take confident steps forward.

To truly maximise your potential, it’s important to look beneath the surface. Sometimes, hidden weaknesses can hold your club or charity back from reaching its goals. If that sounds familiar, our internal audit service can help identify those challenges — so you can strengthen your organisation and unlock its full potential.

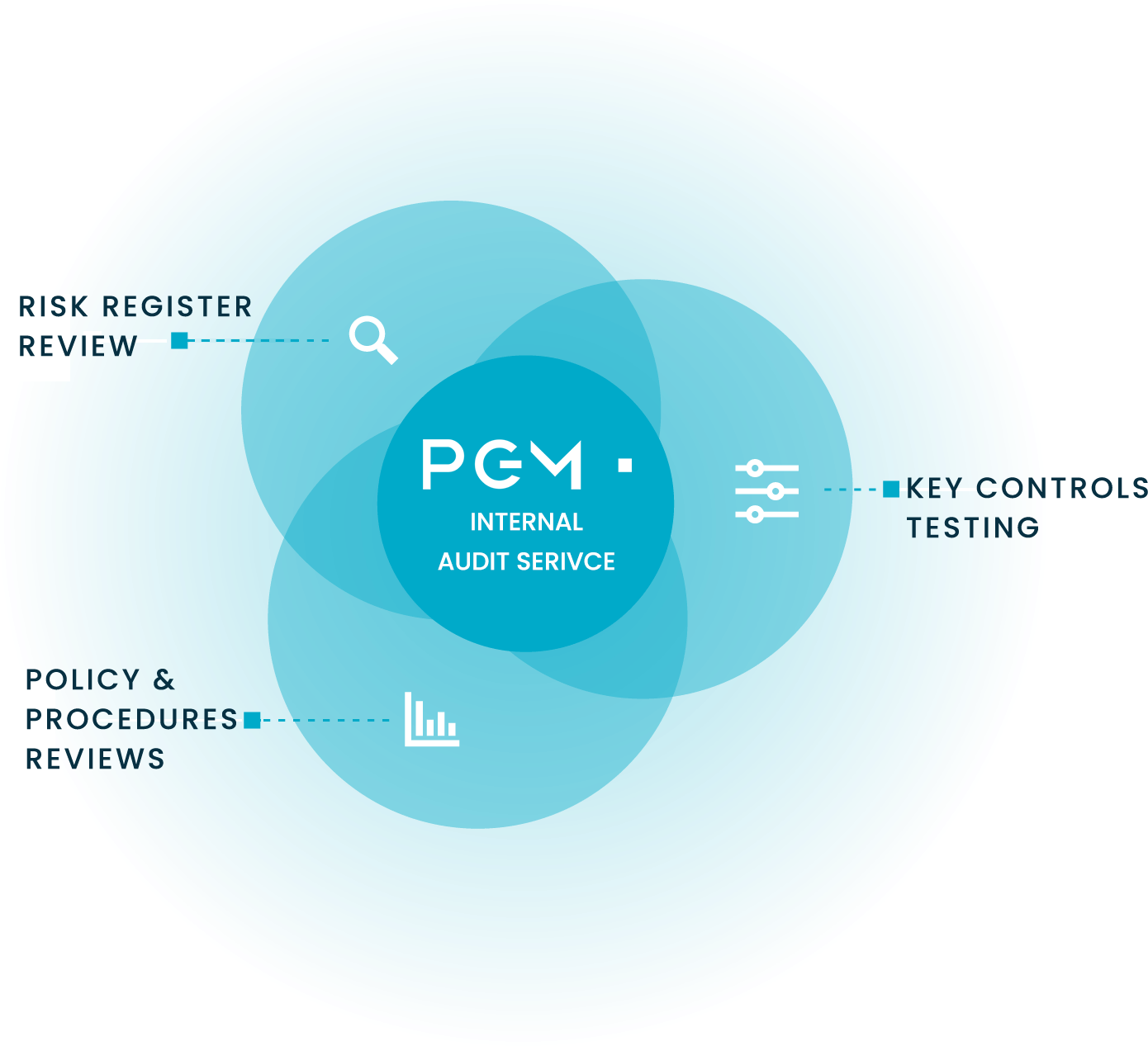

Our approach is divided into three key areas to provide transparency from planning through to reporting.

Our Audit Response System enables us to focus on the processes and requirements most relevant to your company.

Clubs and charities face their own special tax rules and regulations — but with years of experience, our team knows exactly how to manage these complexities with care and expertise.

Want to learn more? Drop by our Belfast or Lurgan office, and let’s talk about how PGM can support you.

Helping Your Club or Charity Reach Its Potential

To make the most of your club or charity, expert guidance on your accounts and procedures is essential. Whether it’s VAT and PAYE health checks or support with auto-enrolment, we’re here to help you achieve your goals.

Auto enrolment has changed the way employers across the UK manage workplace pensions. Most employers are now required to set up a qualifying pension scheme and automatically enrol eligible workers — including making regular contributions every pay period.

With penalties for getting it wrong, it’s more important than ever to stay on top of your legal obligations. We can handle all the auto enrolment processes for you, taking the hassle off your plate and making sure you stay compliant.

Don’t Miss Out on Valuable Savings

You might be surprised how much your business could save through capital allowances. Whether you’re investing in machinery, vehicles, computers, or other big-ticket items, there’s a good chance you could claim on them.

Our team will review your asset spending and help you find the best way to boost your cash flow — making sure you don’t leave money on the table.

Making VAT Less Complicated

VAT can be tricky, especially if your business sells both exempt and VAT-chargeable products — putting you in what’s called a ‘Partially Exempt’ position.

Our team will carefully review your mix of taxable and exempt goods to make sure you avoid any unexpected tax liabilities and keep your VAT affairs on track.

Taking the Worry Out of PAYE Inspections

HMRC PAYE inspections can feel daunting, but our PAYE & NIC health check is here to ease your mind. We’ll review your current setup to make sure everything’s in good order.

While inspections usually happen around every six years, they can be more frequent if there have been past issues. Our review covers payroll, benefits and expenses, Forms P11D, and NIC — helping you stay prepared and compliant.

Applying for Mutual Trading status could mean your charity is exempt from corporation tax on surpluses. Our expert team is here to guide you through the application process and help review your income and expenses to avoid any unexpected tax surprises.

Stay Ahead with Our VAT Health Check

VAT can be complex, but our VAT Health Check helps take the guesswork out of it. We’ll review your VAT setup and transactions to make sure everything’s accurate and compliant—so you can avoid surprises and keep your business running smoothly.

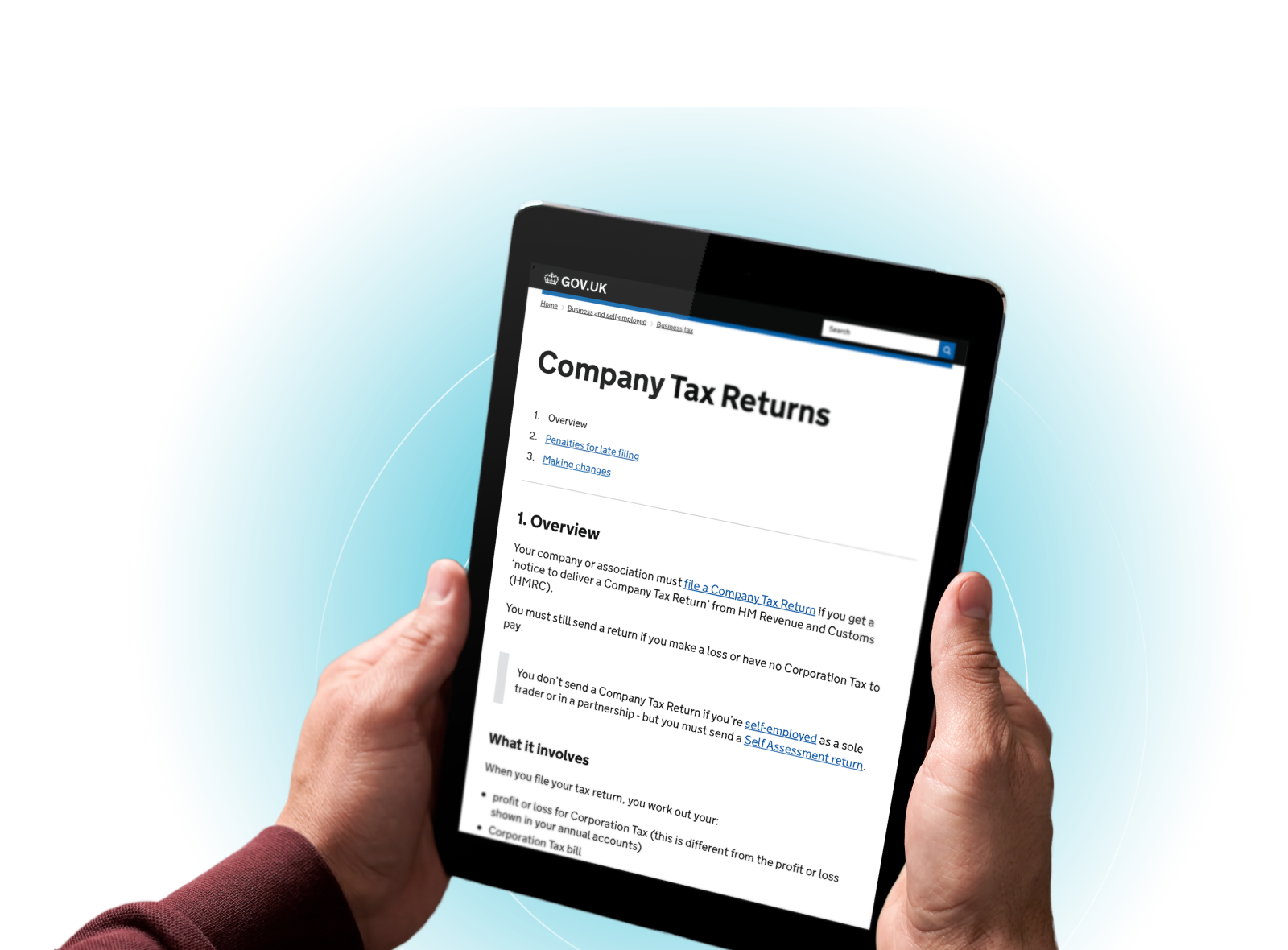

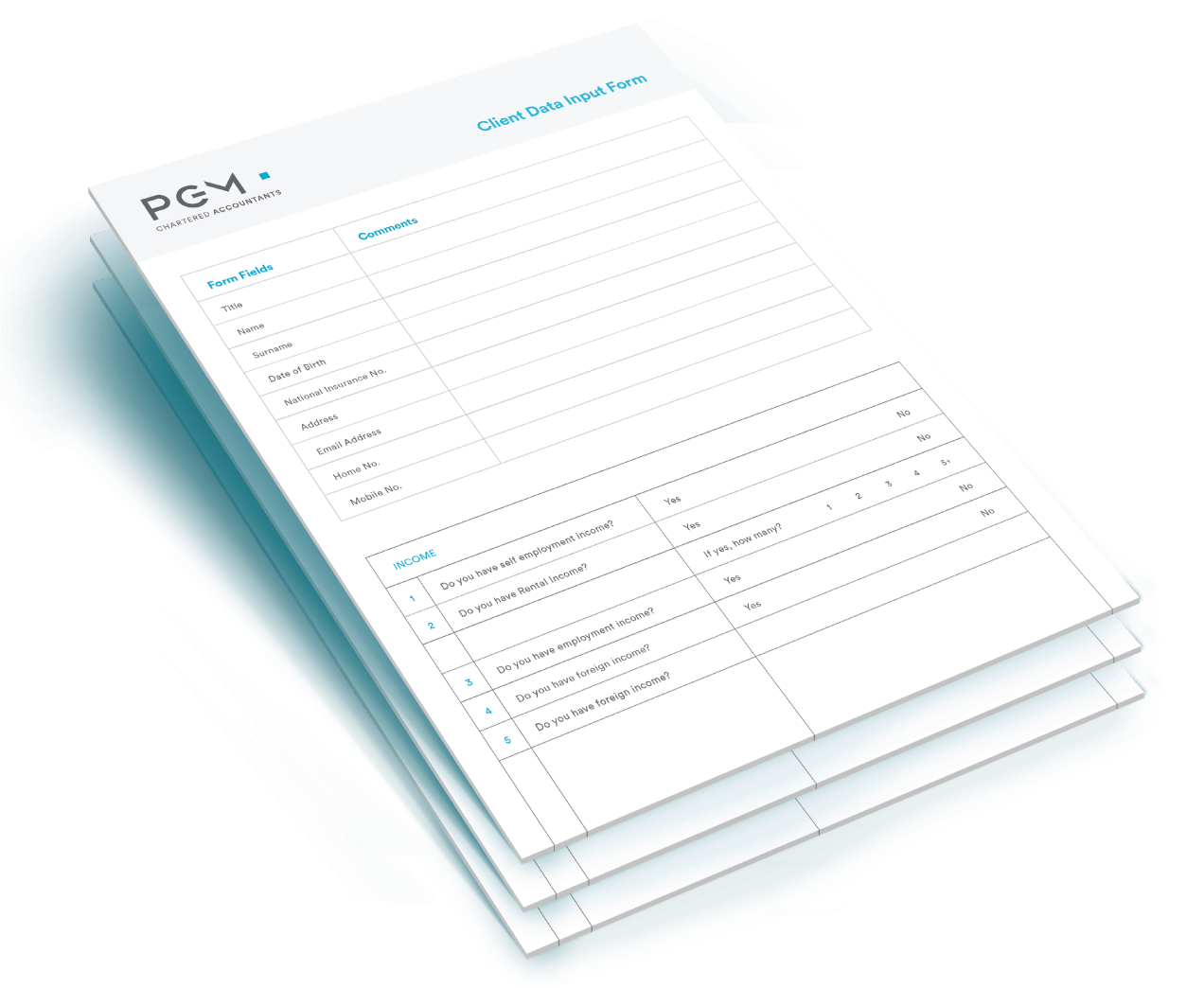

Submitting your tax return couldn’t be simpler with PGM. Our no‑nonsense approach to online tax returns is designed to make your life easier and take the stress out of filing a tax return.

Fill out our registration form and receive a quote within two working days.

We will set up your secure client portal.

Fast and effective submission.

No matter what your club or charity, your industry’s regulatory requirements are crucial to your success. Our audit and assurance services help to identify internal system risks and failings, recommend areas for improvement and strengthen your reputation through essential compliance procedures.

Supporting Your Charity’s Legal Responsibilities

Running a charity comes with specific legal duties. We help all our charity clients with their annual reports to the Charity Commission for Northern Ireland, ensuring everything meets the requirements of the Charities Act (NI) 2008.

At PGM, we stay fully up to date with the latest charity legislation in Northern Ireland — so you can be confident your reports are always accurate and compliant, taking the legal burden off your shoulders.

Trusted Experts in Club Compliance

With over 50 years of combined experience, we know Northern Ireland’s club regulations inside and out. Offering both external and internal audit services, we help spot any compliance issues and provide clear recommendations to keep your club running smoothly.

Helping You Make Every Pound Count

We know that as a charity, your priority is putting funds towards your cause. That’s why we offer a thorough independent examination service that delivers real value for money.

Here’s how the regulations apply to charities:

Turnover under £250,000

receipts and payments accounts – independent examination by an independent person.

Turnover between £250,000 - £500,000

– accruals accounts – independent examination by a qualified person.

Turnover £500,000 +

- accruals accounts – statutory audit by a registered auditor.

Want to find out more about how PGM’s services can help you?

Come and see us for a free 45-minute consultation with one of our qualified chartered accountants. We’ll get to know you, or your business, and explore how our services will be beneficial in providing the financial solutions that you need.